If you are holding a prequalification letter instead, you might be in for a rude awakening. In the competitive Tampa Bay real estate market, knowing the difference between preapproval vs. prequalification can be the deciding factor between getting the keys to your new home or watching someone else move in.

At The Orlicki Group, we believe that an educated homebuyer is an empowered homebuyer. As a local, independent mortgage broker serving Florida and beyond, our mission is to cut through the confusion and provide the honest, expert guidance you need. In this guide, we will break down exactly what these terms mean, why they matter, and how to get the financing power you need to win.

The “Rough Draft”: What is Prequalification?

Think of a mortgage prequalification as a “rough draft” or a quick health checkup for your finances. It is the initial step in the mortgage process, but it carries significantly less weight than a preapproval.

How Prequalification Works

Prequalification is typically a self-reported process. You tell a lender your income, your debts, and your estimated credit score. Based on the numbers you provide, the lender gives you a ballpark figure of how much you might be able to borrow.

Key characteristics of prequalification include:

- Self-Reported Data: The lender usually does not verify your documents (pay stubs, tax returns) at this stage.

- Soft Credit Inquiry: Often, this only involves a “soft pull” on your credit, which does not impact your credit score.

- Speed: It can often be done in minutes over the phone or online.

- Unverified: Because nothing has been proven with documentation, it is not a guarantee of financing.

When is it useful? Prequalification is great for the very beginning of your journey—perhaps when you are just curious about how much house you can afford. It helps you set a preliminary budget, but it is rarely enough to satisfy a seller in the Tampa, FL market.

The “Verified Offer”: What is Preapproval?

If prequalification is a rough draft, mortgage preapproval is the polished, final manuscript. It is a conditional commitment from a lender to grant you a specific loan amount, pending a property appraisal and final underwriting.

The Preapproval Process

To get preapproved, you must complete a formal mortgage application. At The Orlicki Group, we take this step seriously because we know it strengthens your negotiating position. During this stage, we verify your financial background extensively.

We will review and verify:

- Proof of Income: W-2s, pay stubs, or tax returns.

- Assets: Bank statements to verify your down payment and closing cost funds.

- Employment History: Verification that you are currently employed and have a stable work history.

- Credit History: A hard credit inquiry to see your FICO score and debt-to-income ratio.

Why is it better? A preapproval letter tells sellers that a mortgage professional has already vetted you. It says, “This buyer is serious, qualified, and ready to close.” In a multiple-offer situation, a preapproval letter is virtually mandatory.

“Finding the right mortgage shouldn’t be a headache. As an independent mortgage broker, I work for you to secure the best loan options, competitive rates, and fast approvals. I don’t work for the bank.” — Oliver Orlicki, Founder

At a Glance: Preapproval vs. Prequalification

To make it easier to understand, here is a direct comparison of the two statuses:

| Feature | Prequalification | Preapproval |

|---|---|---|

| Data Source | Self-reported by the borrower | Verified by the lender via documentation |

| Credit Check | Usually a soft pull (no impact) | Hard pull (temporary, minor impact) |

| Accuracy | Estimate/Ballpark | Accurate/Conditional Commitment |

| Time Required | Minutes | Hours to a few days |

| Value to Sellers | Low (Seen as uncertain) | High (Seen as a serious offer) |

| Best For | Initial budgeting | Making an offer on a home |

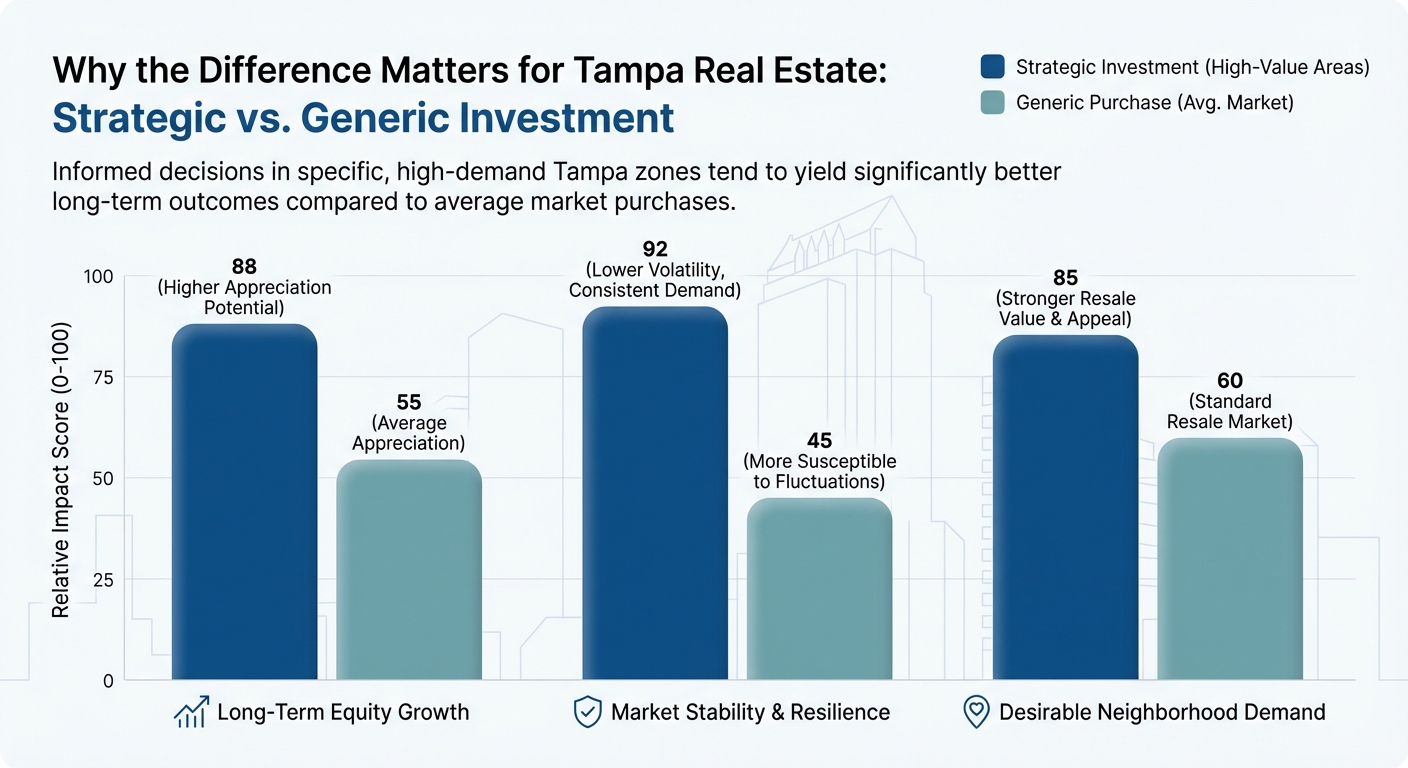

Why the Difference Matters for Tampa Real Estate

1. Gaining a Competitive Edge

Imagine you are a seller. You have two offers on the table for the same price. One buyer has a prequalification letter based on what they said they earn. The other buyer has a preapproval letter from a reputable local broker like The Orlicki Group, confirming their income and assets have already been reviewed. Which offer would you choose? You would choose the sure thing.

2. Knowing Your True Budget

3. Faster Closing Times

Because much of the heavy lifting (document collection and verification) is done upfront during the preapproval stage, the closing process is often smoother and faster. We pride ourselves on fast turn times, helping you get to the closing table without unnecessary delays.

Special Considerations: Self-Employed and Non-Traditional Borrowers

At The Orlicki Group, we specialize in Non-QM loans and solutions for self-employed borrowers. For you, a preapproval might involve reviewing bank statements (12-24 months) or Profit & Loss statements rather than just tax returns. Getting this analysis done before you shop is crucial to ensure you are looking at homes in the right price range.

How to Get Preapproved with The Orlicki Group

Ready to turn your homeownership dreams into a plan? Here is what the process looks like when you work with us:

- Connect with Us: Reach out via our website or call us at (813) 302-1616. We are rooted in the community and focus on building relationships, not just processing transactions.

- Complete the Application: We will guide you through a secure application process.

- Gather Documents: We will provide a checklist of what is needed (IDs, pay stubs, bank statements, etc.).

- We Shop for You: As independent brokers, we aren’t tied to one bank. We shop dozens of lenders to find the best rate and loan product for your unique situation.

- Receive Your Letter: Once verified, we issue a strong preapproval letter that you can attach to your offer.

Whether you are a first-time home buyer or an experienced investor, we tailor the experience to you.

Frequently Asked Questions (FAQs)

1. Does getting preapproved hurt my credit score?

Preapproval requires a “hard inquiry” on your credit report, which typically lowers your score by a few points (usually less than 5). However, this dip is temporary. Furthermore, credit scoring models allow you to shop around; multiple mortgage inquiries within a 14-to-45-day window are usually counted as a single inquiry to minimize the impact.

2. How long is a preapproval letter valid?

Most preapproval letters are valid for 60 to 90 days. This is because your financial situation (income, debts, credit score) can change over time. If your house hunt takes longer than three months, we can easily update your documentation to refresh the preapproval.

3. Can I be denied a loan after being preapproved?

Yes, it is possible, though rare if you maintain your financial status. A preapproval is conditional. If you quit your job, take out a new car loan, or miss credit card payments after getting preapproved but before closing, your loan could be denied. Always consult your mortgage broker before making major financial changes during the process.

4. Is a preapproval the same as a commitment letter?

Not exactly. A preapproval says you are eligible for a loan based on current info. A loan commitment letter is issued later in the process, after a specific property has been identified, appraised, and the file has passed final underwriting conditions. The commitment letter is the final green light.

5. I am self-employed. Can I still get preapproved?

Absolutely. While big banks often struggle with self-employed income, The Orlicki Group specializes in it. We can use bank statement loans or other Non-QM products to verify your income and issue a solid preapproval, ensuring you can compete in the Tampa market just like any other buyer.

Ready to Start Your Home Buying Journey in Tampa?

Don’t leave your home purchase to chance with a simple prequalification. In a market as dynamic as Tampa Bay, you need the confidence and bargaining power of a full preapproval.

The Orlicki Group is here to advocate for you. We work on your behalf—not the bank’s—to find the lowest rates and the most flexible options. Let’s get you ready to make a winning offer.

Get Pre-Approved Today

Call us: (813) 302-1616

Email: info@orlickigroup.com